5 Ways Flexigrow Can Make a Difference

Stress and burnout are significant challenges in the National Disability Insurance Scheme (NDIS) sector. Caring for individuals with disabilities requires extensive attention, patience, and mental resilience. NDIS workers already report long hours, and they shouldn’t be burdened with administrative tasks. To help ease the administrative workload and allow NDIS & Allied Health Business Owners & workers alike to focus on providing exceptional care, Flexigrow offers tailored solutions to streamline business operations and reduce burnout. Streamline administrative tasks When you own a business, the relentless administrative workload can drain your time and energy. From managing claims to processing reports, the paperwork can feel endless and take away your attention from clients, making it difficult to focus on providing quality care. The Flexigrow solution: Manage your business’s finances Manually typing expenses and balancing the numbers on a sheet can take too much time. You’ll also have to worry about tracking and approving reimbursements, creating invoices, and managing cash flows. The piling workload can be overwhelming. But with a powerful tool like Flexigrow, you can reclaim your time and destress. The Flexigrow solution: Track your inventory Many may overlook the importance of properly managing inventory levels and stocks, especially when dealing with consumables and other tangible goods. When not properly tracked, you can miss out on client orders or even overorder which can impact your cash flow. The Flexigrow solution: Centralise your business calendar Working with a team can be a big help when delegating tasks. However, coordinating schedules can be time-consuming. Mismanaged scheduling leads to missed appointments, last-minute changes, and operational inefficiencies that won’t just be bad for you but for your clients, too. The Flexigrow solution: Reduce paperwork and clutter Long work hours become even more exhausting when piles of paperwork greet you at the end of the day. It’s hard to detach from work when you have a cluttered workspace. It’s also highly inefficient and can cause tons of paperwork issues in the long run. You can misplace documents, miss compliance requirements, and waste valuable time hunting down an expense receipt. The stress from a paper-based system is not worth it. The Flexigrow solution: Ready to avoid burnout and optimise your NDIS business? Experience the transformative benefits of a smarter and more efficient NDIS business management system with Flexigrow. Streamline your finance processes by generating digital quotes and invoices, tracking your inventory, managing your team’s schedules, and more with a secure cloud-based software designed for NDIS workers like you. Schedule a demo today to learn more! Reclaim your time and let Flexigrow handle the details.

Streamlining expense reporting with digital expense tracking

Are you still relying on traditional methods to track your expenses? With the increasing popularity of digital expense tracking software, businesses can now simplify their expense reporting and reduce the time spent manually logging expense details on spreadsheets. But how can you benefit from digital expense tracking? Traditional vs. Digital The most popular and reliable method for traditional expense tracking is spreadsheets. It’s quicker to type transactions and integrate different formulas into a spreadsheet to make the necessary calculations Compared to the old pen and paper. Another benefit is the ability to create visual reports, summarising the raw data and making it easier to digest. However, not everyone is well-versed in using spreadsheets. It can also get confusing and overwhelming when you’re logging multiple receipts & supplier Invoices. Digital tracking offers a more convenient and efficient way to manage your expenses for less effort. By using an online platform or mobile app like Flexigrow, team members can take photos of receipts & Invoices generate a digital list of expenses, and categorise transactions in minutes. By being able to store all the receipts within Flexigrow it eliminates the need for hoarding paper receipts and manually entering data, saving you both time and reducing the risk of errors. Especially around tax time & EOFY. Streamline expense reporting Easier data management Digital expense tracking improves the accuracy of your data by relying less on manual entry. Most spreadsheet users automate the categories and filters, which you can then customise to your liking. Filters can be set up in Spreadsheets, but the platform can be temperamental. So, besides human error, one wrong formula or accidental change can mess up the entire expense worksheet. Digital expense trackers are generally more accessible to the whole business and more accurate for a business and staff. Automate reporting process Spreadsheets can generate graphs and visual reports. The downside is that they may require more advanced and in-depth spreadsheet training & knowledge. Real-time updates can be trickier to generate. But with a digital expense tracking platform like Flexigrow, you will have the ability to automate the reporting process. It can convert raw data into real-time & up t the minute visual reports, This level of visibility and control can help businesses optimise their spending and improve overall financial management with better insights into spending habits of the business. Promote transparency With real-time updates in digital expense tracking, managers can monitor expenses more accurately, ensuring compliance with company policies and regulations. It also makes sharing information between teams much more accessible, reducing the risk of fraud and misuse and promoting a culture of accountability within the organisation. Cost-saving-benefits Digital expense tracking provides numerous cost-effective benefits that can revolutionise your financial management system. These include reducing time spent on admin work, improving spending control, enhancing compliance, and better financial forecasting. Digital expense tracking can help you focus on more productive tasks to grow your business. Choosing the software for your business The goal is to make your expense tracking process more efficient and manageable. So, before you commit to introducing new software to your finance processes, it’s important to conduct a testing phase. Try out different software or apps. Ask as many questions as possible until you’re 100% confident that your business’ needs will be met. Start your journey to better finance management with Flexigrow’s Business Management, now available online and through our app. Digitise receipts and streamline expense reporting with ease. Sign up today and try the app free for 30 days—no credit card required. Discover how Flexgirow can push your business forward.

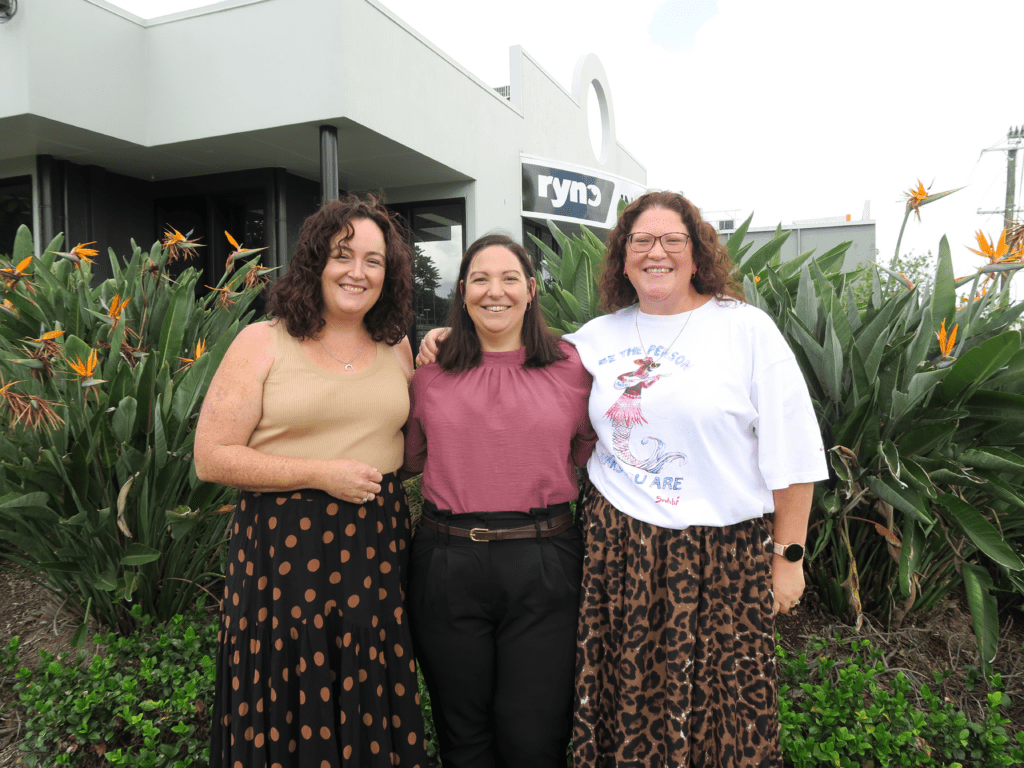

Accelerate Action: Championing Women in the Workplace

Introduction At East West Group, we have long championed gender equity in insurance, fostering an environment where women can excel through inclusive leadership, flexible work structures, and targeted development programs. Now, as we expand into SaaS, we are committed to ensuring that the same level of support and opportunity exists for women entering and advancing in the tech sector. The journeys of Amanda, Erin, and Sam illustrate the kind of support we have provided in insurance and the foundation we will carry forward into SaaS. Building Pathways for Women: Our Foundation in Insurance Amanda began her career at East West Group as a receptionist with no prior insurance experience. Through structured mentorship, continuous learning, and an open culture, she transitioned into underwriting, contributing directly to product innovation. She recalls the moment she saw one of her insights shape the business, saying, “One of my insights led to the development of a new product—seeing my input shape the business was a defining moment.” The flexibility offered at East West Group also played a key role in her growth. Moving to a compacted workweek allowed her to balance work and personal responsibilities seamlessly. For Erin, her journey started in a part-time support role as she balanced her career aspirations with motherhood. Encouraged by her peers and leaders, she stepped into leadership, backed by the company’s sponsorship of the Aspire Women Leaders Program. “The program was challenging but transformative,” she explains. “Knowing that my company backed me fully was invaluable.” The company’s commitment to providing genuine career development and structured flexibility enabled Erin to thrive and contribute at a higher level. Sam joined East West Group after feeling stalled in her previous role. She was drawn to a workplace that would challenge her and provide real opportunities for progression. The inclusive and supportive environment made all the difference. “I hope my daughters find their ‘East West’—a workplace that supports them as individuals and professionals,” she says. Having experienced firsthand how an organisation can empower its people, she is passionate about continuing to build a workplace where success is not hindered by outdated work structures or traditional biases. Bringing This Commitment to SaaS The gender gap in technology remains significant, with women holding just 28% of computing and software development roles. As East West Group expands into SaaS, we are determined to create an environment that actively breaks down barriers and fosters a culture where women can thrive. Just as we have built pathways for women in insurance, we intend to do the same in tech. Clear progression pathways and opportunities to advance will be available to our team members. Development programs will be tailored to SaaS, equipping team members with the skills and confidence to grow their capabilities. Workplace flexibility will remain a consideration, allowing professionals to balance work and life without compromising their ambitions. Transparent and equitable pay structures will be upheld to prevent gender pay gaps from emerging in our SaaS division. Looking Ahead: Accelerating Action in SaaS Just as we have reshaped opportunities for women in insurance, we are excited to do the same in SaaS. A truly inclusive workplace benefits everyone—not just women, but the entire organisation and industry.

Hidden costs of ineffective business expense management

An effective business expense management system is more than just balancing a budget on a spreadsheet. It’s an important strategy for maintaining the financial health of any business, requiring precision and attention to detail. When business expenses are not managed efficiently, the results can be more damaging than just immediate overspending. Even seemingly minor oversights, like missing small expenses, can quickly accumulate and snowball into costly mistakes. Here are some hidden costs that can result from poor business expense management: Increased risk of fraud and finance mismanagement Trust is a valuable resource in business. But despite stringent hiring processes that filter out bad actors, there’s still a risk of fraudulent activities and financial mismanagement, both within the business and with vendors. That risk can increase significantly without a clear monitoring or stringent approval process for business expenses. When expenses aren’t closely monitored or accurately tracked, key details can be overlooked, making detecting fraud difficult. This can result in severe financial losses that damage your business’s reputation and undermine team and partner trust. In fact, the Association of Certified Fraud Examiners (ACFE) reported in a 2020 Global Fraud study that approximately 5% of total revenue loss can be linked to fraud, with some cases being a attributed to poor expense management. Late payments Another common issue tied to poor expense management is late payments. A 2021 report by Accenture, supported by Xero, found that nearly 48% of invoices issued by small business owners were paid late, with over 10% taking more than a month to be settled. This is especially problematic for small businesses in Australia, where invoices are paid, on average, 6.4 days late, resulting in a staggering $1.1 billion in annual costs. This alarming number is because late payments cause a ripple effect in a business’s cash flow. When there’s a delay, covering expenses from employee reimbursements to operational costs can be a struggle. The pressure can be eased by efficient business management. By accurately tracking and forecasting cash flow, businesses can better anticipate when funds will be available and plan accordingly. Did you know? Flexigrow helps prevent late payments by integrating invoicing with automated reminders, so you never have to worry about unpaid invoices again. Strained work relationships Poor business expense management can harm relationships within your team and with external partners. Mounting delays in reimbursements and confusing approval processes can frustrate and make your employees feel undervalued. These can then lower morale and impact their productivity. Expense mismanagement also leads to poor cash flow and delayed vendor payments. This might lead them to charge fees, demand upfront payments, or even sever ties with your business, which can hurt your reputation and make it harder to negotiate favourable terms. Tax fines, penalties, and missed deductions The stakes are high during tax season, and it’s stressful enough without the added baggage of a messy financial report. If expenses are not accurately tracked throughout the year, your team may find themselves scrambling to balance the numbers, increasing the chances of missing important requirements and deadlines. This not only impacts your team’s stress level but also disrupts your company’s overall cash flow. Inaccurate financial reports can trigger audits and fines, putting your business at risk. Additionally, failing to track expenses properly can result in missed tax deductions, leading to overpayment and further draining your cash flow—resources that could have been reinvested in your business. Difficulty in securing potential investors When negotiating for credit or funding, a business is heavily scrutinised to determine if it’s worth investing in. Potential investors and partners will analyse your financial health, test your operational efficiency, and perform risk assessments. So, when expenses aren’t managed well, presenting a clear and convincing financial picture becomes challenging, which may discourage investors. And without access to necessary capital, the business may struggle to meet operational needs. That’s why it’s important to have an efficient business management system that allows for accurate financial reporting. The better you manage your business expenses, the more confidence potential investors will have in you. Keep your business finances healthy A strong business expense management system can help you avoid these hidden costs and set your business up for long-term success. By streamlining your processes, improving cash flow, and investing in powerful tools, you can can further boost your productivity and avoid unnecessary risks like late payments. AI-powered expense systems can cut tracking time by up to 80%, allowing teams to focus on strategic tasks instead of paperwork. Looking for a solution? Flexigrow’s AI-powered business management platform can provide end-to-end solutions, from sending quotes to invoicing and receiving payments. Plus, with our scan-and-go feature, you can create digital copies of receipts and replace paper clutter with a more accurate expense tracking system that automatically generates financial reports. Start with our 30-day free trial today and transform how you manage your business.

Embracing new social platforms for marketing growth

Embracing new social platforms for marketing growth The importance of embracing new social platforms to drive marketing growth cannot be overstated. With the ever-evolving landscape of social media, businesses must stay ahead of the curve and adapt to the latest trends and technologies. Instagram: Showcasing creativity and engagement Instagram has evolved into a powerhouse business platform, offering visually appealing content opportunities and influencer partnerships. By leveraging features like stories and reels, businesses can authentically connect with their audience and drive engagement. According to Meta’s advertising tools, it is estimated that Instagram had 13.95 million users in Australia in early 2024. LinkedIn: Establishing thought leadership LinkedIn provides a professional space for businesses to network, share industry insights, and establish thought leadership. With over 15 million Australians having profiles, LinkedIn remains a vital platform for professionals and businesses seeking to connect and engage within the professional sphere. Through informative and engaging content, companies can position themselves as industry experts, attracting a B2B audience interested in their offerings. TikTok: Embracing creativity TikTok has emerged as a platform for short-form video content. Brands embracing TikTok’s creative format can tap into new audiences and drive engagement through challenges, trends, and user-generated content. TikTok has grown significantly in Australia, becoming the 4th most popular social media app. Embracing new social platforms is essential for driving marketing growth in today’s digital age One of the key benefits of embracing new social platforms is the ability to reach a larger and more diverse audience. With billions of users on platforms like Instagram, LinkedIn, and TikTok, businesses can connect with people from all walks of life and introduce their products or services to a broader demographic. This can lead to increased brand awareness and ultimately drive growth for the business. By staying active on new social platforms, businesses can stay ahead of their competitors and position themselves as industry leaders. By showcasing their expertise and engaging with customers in real-time, companies can build trust and credibility with their audience, increasing customer loyalty and repeat business. While constantly adapting to new social platforms may seem daunting, the benefits far outweigh the challenges. By investing time and resources into exploring and utilising new platforms like Instagram, LinkedIn, and TikTok, businesses can stay relevant and continue to grow their marketing efforts in an ever-changing digital landscape. Staying ahead of the curve and connecting with customers on a more personal level through platforms like Instagram, LinkedIn, and TikTok, businesses can increase brand awareness, build trust, and ultimately drive growth for their company. So don’t be afraid to step out of your comfort zone and explore new social platforms – the rewards are well worth the effort. Step up your marketing game further with our practical marketing tips.

Factors to consider with digital expense-tracking apps

Managing finances is a crucial aspect of modern life, and digital expense-tracking apps have made this task significantly easier. These apps help users monitor their spending, budget effectively, and save money. However, as with any digital tool, there are certain considerations and potential pitfalls to be aware of. Here are a few things to watch out for and questions you need to ask before investing in a new finance app: Data Security and Privacy One of the primary concerns when using any finance app is data security. Expense-tracking apps frequently need access to sensitive information, including bank accounts, credit card details, and personal identification data. Look for apps that provide strong encryption and secure login methods. What security measures do they take? Ensure the expense-tracking app implements security protocols such as end-to-end encryption, secure login methods like two-factor authentication, and regular security audits. Additionally, confirm that the app complies with industry standards and regulations to protect your data against unauthorised access and breaches. What is their Privacy Policy? Read the app’s privacy policy to understand how your data will be used and shared. Will they be sharing data with third-party vendors? Do they mention using data for marketing purposes? How about data storage? What permissions requests do they make? Choose apps that only request access essential for their functionality and avoid those that ask for unnecessary permissions to access data on your phone. This approach minimises risk and helps protect your personal information from potential overreach. Cost and Hidden Fees Free subscriptions will likely have limited functionality, which will encourage you to subscribe for a paid one. So, before you sign up for a particular app, read the fine print to avoid surprise charges. Are there recurring fees? If you’re signing up for a trial period, you may be required to provide payment details. But before you hit subscribe, check for any mention of recurring subscription fees. If you don’t intend to continue with the service, remember to cancel the subscription before the trial period ends to avoid being charged. Do they offer in-app purchases? Free subscriptions will likely have limited functionality to encourage you to subscribe for a paid one. Also, be cautious of in-app purchases required to unlock essential features. User-Friendly Interface A quality expense-tracking app should feature an intuitive and user-friendly interface. The last thing you want is to spend hours figuring out how to use a complicated expense-tracking app. Choose an app with straightforward navigation and a clear interface to simplify the process of managing your expenses, making it both efficient and hassle-free. Is it easy to use? The app should be straightforward, featuring clear instructions and a well-organised layout. This ensures that users can navigate the interface effortlessly and access the necessary features without confusion, making the experience smooth and user-friendly. Are there visual guides? The ability to digitise receipts and list expenses is great, but you also have to consider whether the app can generate charts or graphs. Visual representations can significantly enhance your understanding of spending patterns, making it easier to identify trends and adjust your budget. Compatibility and Integrations A new app offering tons of new features can be very exciting. However, before jumping into a subscription, you need to consider the tools you already have and if they are compatible. If the tools and services you’re using are working for you, then it wouldn’t make sense to use an app that forces you to overhaul your system. Ensure the app is compatible with your devices and other financial tools. Is there a required operating system? Check if the app is compatible with your devices’ operating systems (e.g., iOS, Android). Is the app accessible in cross-platform? Working or tracking your expenses from a phone may be convenient but it’s beneficial if you can access the platform in multiple devices (iPad, tablet, laptop). Make sure that the app also supports cross-platform syncing. What are available integrations? Look for apps that integrate with other financial tools and services you use, such as accounting software, investment tracking, or tax filing tools. Customer Support and Updates Even a great product or service can have issues. When subscribing to a digital expense-tracking platform or app, ensure they provide reliable customer support. How fast do they respond to inquiries? Adequate customer support should be available and accessible to contact through various email, chat, or phone channels. How often are updates provided? Go to the App Store and check the app history to see if they regularly create updates to fix bugs and improve features. Ask questions and invest wisely in expense-tracking Digital expense-tracking apps can be incredibly beneficial for managing your finances, but choosing the one that fits your needs is as important as understanding how to maximise its features. Take the time to ask questions until you feel confident before committing resources to a platform. Do your research, read reviews, and start with a trial version before getting a paid subscription. Flexigrow is offering a 30-day free trial period for the new Business Management app, now available on iOS and Android. Experience the power to simplify digital expense-tracking with effortless receipt scanning and item categorisation. Schedule a demo today and see how it works.

Sustainability business practices in 2024

Australia’s goal of net zero carbon emissions by 2050 has focused on integrating sustainability into business strategies. This has since fostered innovation, resilience, and prosperity, and is now seen as an ethical obligation. By making sustainability a fundamental part of business strategies in 2024, risks can be managed, regulatory standards met, and brand image enhanced while creating value for all stakeholders. Defining Sustainability Before starting your journey toward carbon-free emissions, you must define what ” sustainability ” means for your business. Sustainability involves promoting practices and implementing strategies to minimisenegative environmental impact. This can include reducing carbon emissions and waste generation, promoting renewable energy sources, and investing in eco-friendly technologies and infrastructure. It also aims to preserve natural resources and maintain ecological balance while supporting human progress. So, ultimately, sustainability aims to create a world where we and future generations can safely thrive. Now, what does that entail for your business? Calculate your business carbon footprint One of the most effective ways to reduce your carbon footprint and contribute towards a sustainable future is to assess your business’s environmental impact. Carefully review your process to identify areas with direct or indirect carbon emissions. Gather as much data on your energy consumption, including electricity, gas, and fuel usage. You can also look into your transportation emissions, whether from company vehicles, employee commuting, or frequency of business travels. Additionally, consider the emissions from waste disposal and any other significant sources specific to your industry. You can estimate your business’s carbon footprint by visiting Carbon Positive Australia’s website and registering to access their online calculator. By analysing the results, you can identify areas where emissions are being generated at a high rate, and strategise on how to reduce them. It’s also important to regularly monitor and report on your progress toward your carbon-free emission goals. Consistency is critical in demonstrating your business’s commitment to environmental responsibility. Implement circular economy model practices The world is used to a traditional “linear economy” where resources are used up and then thrown away, including non-recyclable and one-time-use plastic products or packaging. However, to achieve sustainability, we need to adopt circular economy practices. Thecircular economy framework aims to reduce waste, optimise production, and maximise resources by prolonging their usage. The goal of the circular economy is to complete the resource use and production cycle to promote sustainability and protect the environment. Here are samples: Create strategic eco-partnerships Australia is currently partnered with other countries like Germany, Japan, India, and the United States for mutually beneficial international projects. An example is the Australia-Germany Hydrogen Accord, which focuses on developing the renewable hydrogen industry. Another is the Australia-UK Clean Technology Partnership, where both countries explore and support one another in industrial decarbonisation efforts. As a business, you can promote sustainability and reach your net zero emission goals by forming similar partnerships with local organisations dedicated to reaching the country’s 2050 net zero carbon emissions goal. Connect and collaborate with these organisations: Forming partnerships is an essential method of sharing the best and latest environmental conservation practices. When you’re struggling to achieve carbon-free emission goals, partnerships can provide much-needed support and even refer you to others who can help. Collaboration with like-minded individuals, organisations, or community groups furthers innovation and sustainable solutions that can benefit everyone. Engage with stakeholders and employees in community efforts Establishing partnerships at a corporate level is just the beginning. Promoting sustainability by engaging stakeholders and employees in local community efforts is also encouraged. Businesses can foster a sense of responsibility by involving everyone, creating more positive environmental impact, and enhancing connections. Establish volunteer programs and participate in community service projects. These activities enable individual stakeholders and employees to become more proactive in the net zero carbon goal. So, it benefits the local community’s initiatives, promotes employee social responsibility and enhances the company’s reputation as a driving force for positive change.

How Digital Expense Tracking Transforms Tax Filing

As the deadline for filing taxes approaches, many individuals and businesses find themselves hurriedly collecting various financial documents, from income statements, investment reports, and expense receipts, to ensure compliance with tax regulations and timely submission of tax returns. However, collecting receipts and tracking expenses becomes a daunting ordeal as they can be quickly scattered or lost, making it challenging to compile a complete record when tax time rolls around. With the added pressure to accurately account for every transaction and avoid penalties, it’s no wonder that tax season can mean long hours and frustration. But with digital expense tracking, you can streamline your finance management process and make it easier to file taxes. What is digital expense tracking? Expense digitising involves converting paper receipts and invoices into digital files that can be easily stored and accessed electronically. This process can be done using a scanner or a mobile app that allows you to take photos of your receipts and automatically upload them to a cloud-based system. Compared to traditional expense tracking, going digital makes for a more straightforward, faster, and more convenient finance management process. By digitising your expenses, you can have all your financial documents in one place, making tracking and managing your spending throughout the year easier. Beyond that, digital expense tracking offers several benefits that can significantly streamline personal and business financial management, especially when filing taxes. How can you benefit from going digital? Quick and Accurate Tracking One of the standout advantages of digital expense tracking is the high level of accuracy it offers by eliminating manual data entry errors. Business Management apps like Flexigrow offer the convenience of scanning receipts instantly, which ensures that the data is automatically captured and uploaded to the platform for precise, real-time expense tracking. Additionally, Flexigrow provides options to import and export expense data in bulk so you can easily integrate previous records into the system. Organised Information Another key advantage of digital expense tracking is the convenience of categorising and organising expenses. Most platforms automatically sort entries into categories like supplies, travel, and transaction types, which greatly simplifies financial reporting. The automated feature can also save you considerable time and effort during tax season, as you won’t have to sift through piles of paper receipts. You can log on to the platform, set a filter, and search if you need to find a specific transaction. Real-Time Updates The simplicity of record-keeping provided by digital expense tracking platforms significantly improves the ease of consistently updating expense tracking, leading to enhanced accuracy in tax estimates. You can scan a receipt or upload it to the platform without manually going through each item or expense. It streamlines the process to ensure all eligible business expenses and deductions are accounted for, potentially lowering your taxable income and optimising your financial strategy. Detailed Insights and Visual Reports Digital expense tracking systems not only help categorise expenses but also provide detailed insights into spending habits. They can generate real-time summary reports or graphs, which are useful for team collaboration, as they offer a clear visual representation of financial health. Visual data representation ensures that all team members can meaningfully engage in conversations about budgets, spending, and financial strategies regardless of their financial expertise. Accessible Cloud-Based Storage Traditional expense tracking systems often lack real-time updating and accessibility. This means that insights into financial performance aren’t readily available, which can delay decision-making. The storage and retrieval of paper documents can also be inefficient. Digital expense tracking platforms make your financial information accessible from anywhere and anytime. By storing expenses digitally, you can back up your files securely and access them from any device connected to the internet, reducing the risk of losing crucial financial documents. It’s particularly helpful for businesses needing to manage expenses across multiple employees or various locations. Flexigrow enhances this convenience further. The platform allows you to easily add users and tailor access, ensuring everyone, from team members to accountants, can retrieve the necessary information. Convenient Tax Preparation Digital expense tracking simplifies the updating, tracking, and categorising of financial records, effectively reducing the year-end rush to organise finances. Many digital tracking apps integrate with popular tax software, enabling automatic pre-filling of tax forms with relevant financial data. These seamless integrations streamline the tax filing process, saving time and minimising manual entry errors for a less stressful tax preparation season. Audit Preparedness Accurate and well-organised records reduce the likelihood of errors that could trigger an audit. When all your documents are systematically stored and readily accessible, responding to inquiries from tax authorities becomes straightforward and stress-free. Moreover, some digital tools have features to create an audit trail, providing invaluable assistance during financial audits or reviews. This makes it easier to comply with regulations and ensures solid financial management. Navigate the tax season with confidence Overall, expense digitising offers an efficient way to streamline your finance management and make tax preparation less stressful. While it may not be essential for everyone, the benefits are worth considering for those looking to simplify their financial management process. By embracing digital expense tracking, you can say goodbye to the headache of manually inputting and organising receipts, all while gaining valuable insights into your financial health. Flexigrow’s Business Management platform is a game-changer in this regard. With its built-in scanner that automatically collects data from receipts and invoices, you can save time and get accurate expense tracking. Take advantage of our 30-day free trial and see how Flexigrow can transform your finance management and tax preparation process. Want to learn more? Schedule a demo with us today.

Wearable tech you should check out in 2024

What is wearable tech? Staying on top of your health and wellness is a fundamental task. Luckily, there are now many gadgets that can help you improve your overall wellbeing. Wearable tech has gained popularity in recent years, and for good reason. These gadgets do everything from tracking your heart rate to improving your posture. Here are some that you should invest in and why they are beneficial. Sports watches Smartwatches like the Apple Watch or Fitbit Versa are incredibly diverse wearable tech tools. These devices can support your fitness journey with features like heart monitoring, sleep tracking, and exercise tracking. They allow you to better track calories burnt and your exercise pace. This real-time feedback on your health metrics is a surefire way to improve your general health, as you have numbers to prove the changes you must make to improve your lifestyle. Whether you’re hitting the gym or going for a jog, smartwatches like these are your go-to for keeping tabs on your progress and staying motivated! Smart eyewear Smart eyewear, a unique form of wearable tech, offers a range of benefits. Imagine your glasses not only improving your vision but also aiding in navigation, thereby enhancing road safety for both drivers and cyclists. This eliminates the need to constantly check your smartphone for directions, making your journey smoother and safer. Smart eyewear can offer immersive augmented reality (AR) and virtual (VR) experiences. From pointing out local historical sites and restaurants of interest while you’re moving, to transporting you to a virtual world, why not try them? The eyewear can also offer the same exercise-tracking benefits as the smartwatch. If you’re running or cycling, this could greatly benefit you. Smart jewellery Stay informed and be stylish! Jewellery such as rings and bracelets, which measure your heart rate, daily steps and more, integrate into your daily life while not being outwardly visible and compromising your style. Like smart watches, smart jewellery allows you to make positive changes to your life, thanks to their personalised health-related recommendations, and easy access notifications encouraging you to reach your daily step count. Some smart jewellery also helps with stress management, as the jewellery detects changes to heart rate, skin temperature, and more. This can support offering insights into stress management for those with high-stress jobs or who are managing anxiety, and it offers quantifiable insights to help them try different techniques. Wearable tech is a dynamic field constantly evolving, offering new and improved ways to enhance our lives. It’s a great addition to many people’s lifestyles, helping them live healthier and happier lives. To explore other tech that can support your daily workplace operations, consider the Flexigrow suite of tools. Visit our website for further information on how our tools can help build a greater business.

How to maximise your resources

Optimising your resources is fundamental to achieving success. In this blog, we’ll explore practical tips to help small business owners optimise their time, money, talent, and technology effectively. Prioritise and set goals Begin by setting clear goals to guide your efforts. Whether boosting sales, improving academic performance, or enhancing workplace productivity, clear objectives allow you to allocate your resources more effectively. Prioritise tasks based on these goals to ensure you’re focusing on what matters most. Delegate! Think outside the box and explore creative solutions to challenges. Embrace technology, network with others for insights, and find efficient ways to utilise your time. Additionally, learn to delegate tasks to leverage the skills of others and free up your time for more critical endeavours. Evaluate and adjust Maximising resources is an ongoing process that requires adaptability. Regularly assess your goals, tasks, and strategies to ensure they align with your objectives. If something isn’t working, be flexible and willing to adjust your approach to optimise resource utilisation. Time management Effective time management is essential for small business owners. Prioritise tasks, set deadlines, and consider using time-tracking tools and scheduling software to streamline workflows and boost productivity. Remember, focusing on one task at a time can enhance efficiency and reduce stress. Smart money management Manage your finances wisely by creating a budget, tracking expenses, and monitoring cash flow. Look for opportunities to save costs, such as negotiating with suppliers and investing in cost-effective solutions. Utilise accounting software and seek professional financial advice for valuable insights. Maximising technology Make the most of technology to boost productivity and efficiency. Use cloud-based solutions, project management tools, and automation software to make tasks easier and communication smoother. Keep up with tech trends to find new ways to integrate valuable tools. Lifelong learning Networking and forming partnerships can provide valuable resources and support. Actively seek networking opportunities and collaborate with complementary businesses to expand your reach. Invest in continuous learning through workshops, courses, and mentorship to stay competitive in the ever-evolving business landscape. Business owners can achieve growth and success in today’s competitive environment by implementing these strategies for maximising resources.